In previous articles, we have covered the different ways a landowner could structure the sale of their land for development, dependent on their attitude towards risk and reward. This might include working with a development partner or forming a joint venture.

In this article we consider some of the options and implications for owners of neighbouring sites being considered for development.

Taxation of development land sales

It is worth recapping on the high-level tax position when it comes to the sale of land.

Capital gains tax

Where land is sold for development, ordinarily that sale would be a capital sale and subject to capital gains tax (CGT). Often, the full CGT liability will arise upfront, even where sales proceeds are receivable in tranches over several tax years, which can lead to cash flow issues. This can also include contingent (but ascertainable) payments, on the initial assumption that the contingent events will occur. Where certain conditions are met, CGT can be paid in instalments.

With careful planning, a disposal could qualify for Business Asset Disposal Relief (BADR), whereby CGT is payable at 10%, up to a lifetime limit of qualifying gains of £1 million. A development land sale may qualify, for example, where the land being sold has been used in a qualifying trade, the trade ceases and the land used in the trade is disposed within three years.

Income tax

There are instances where a sale of land can be subject to income tax and we highlight a few now. Where the landowner is a developer themselves, even the sale of undeveloped land could be deemed to form part of their trading business and be subject to income tax.

It is common for development land sales to be structured such that the landowner receives an overage payment, or a ‘slice of the action’ – effectively a structured share in the profits of the eventual development. Overage receipts are generally taxed as income, rather than capital gains, as they’re linked to trading activity, being the development and sale of the developed units.

If the landowner receives a house or houses as part of the deal, the value of the property received will generally also be liable to income tax.

VAT

A grant of an interest in land is an exempt supply for VAT purposes and no VAT is chargeable. However, if the party making the supply opts to tax the land for VAT purposes, VAT will be charged when the land is sold. The option to tax enables the grantor to reclaim VAT on costs, which would otherwise not be recoverable.

Multiple ownership considerations

Moving on to land sales where there are multiple owners:

It is common that land will be identified for development and that land will be held under multiple neighbouring ownerships. For example, Farmer X owns area A, Lady Y owns area B and Lord Z owns area C, but a developer wants to develop the whole ABC plot.

There are several ways in which such transactions can be structured.

Equalisation agreements

Equalisation agreements are common. Under an equalisation agreement, the owners share sale proceeds between them in agreed proportions, regardless of who sells the land.

The agreed proportion is generally based on the split of the market value of the land owned by each party. An equalisation agreement therefore protects each owner’s position and ensures they receive their fair share from the deal. It prevents the individual landowners from holding one another to ransom, where, for example, one landowner owns the element prime for high end housing and another owns the element prime for affordable housing, but the development cannot proceed without the whole.

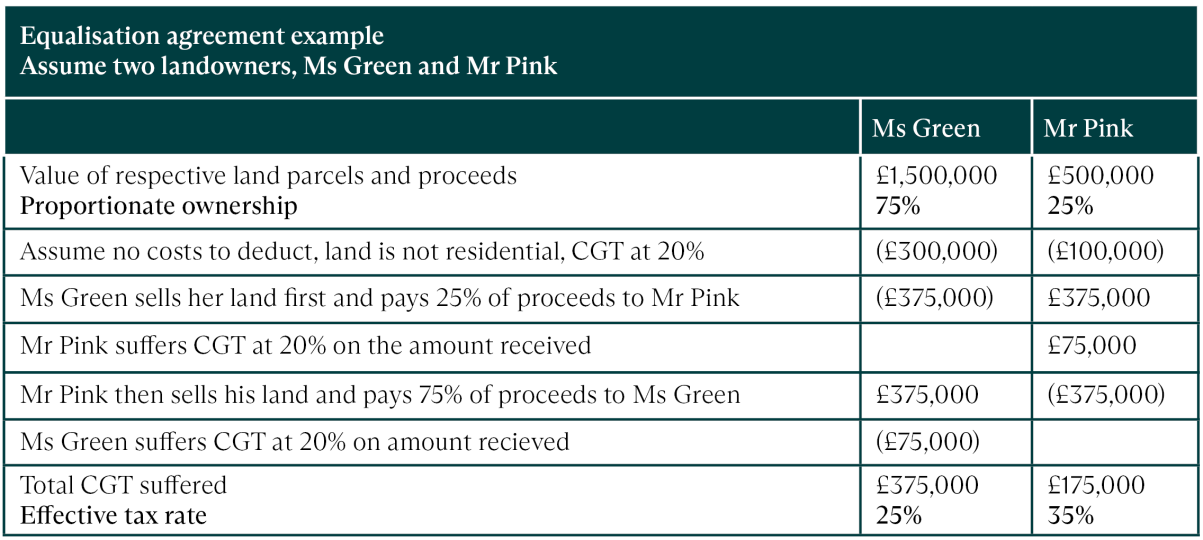

The main issue with equalisation agreements is the element of double taxation, as shown in the example below.

To mitigate the double taxation, cross options or cross covenants can be used.

Equalisation agreement example: Assume two landowners, Ms Green and Mr Pink

Cross options

With a cross option, each landowner grants an option to the other, for them to acquire a share in their land, exercisable when planning permission is granted, but at the market value of the interest at the date of the grant.

The granting of the option is a disposal for CGT, with each party being subject to CGT on the value of the option received. It is therefore essential that the options have a low value. That generally means that the options must be granted when the land still has just agricultural value and before any ‘hope’ value accrues.

The granting of an option to acquire land is considered a grant of an interest in that land, which is a VAT exempt supply, subject to the option to tax.

Whilst there may not be consideration in terms of cash payable with respect to such grants in these circumstances, the various options granted will often create a series of barter transactions and careful VAT planning is required to ensure no one landowner is left disadvantaged from a VAT perspective.

Cross covenants

With a cross covenant, each of the landowners grants a restrictive covenant to the other landowner. That prevents any development without the consent of the holder of the restrictive covenant. The developer needs to pay the holder to release that covenant so that the development can proceed.

Again, the granting of the covenant is a disposal for CGT, with each party being subject to CGT on the value of the covenant received, and so it is essential that the covenants have a low value.

Payments for lifting a restrictive covenant are consideration for the surrender of a right over land and are therefore exempt from VAT, subject to the land being opted by the holder of the covenant. The placing of the restrictive covenant in these circumstances is not a supply for VAT purposes.

Cross options and cross covenants are therefore generally only effective in passing on or sharing future uplift in value. Neither cross options, nor cross covenants, will qualify for BADR.

Land pooling

A more effective solution can be to use a land pooling arrangement.

With a land pooling arrangement, each landowner contributes their land into a bare trust and in doing so, effectively swaps their 100% interest in their own land, for a proportionate undivided interest in the whole developable area, with the proportionate interest based on the respective value of the land contributed.

When the land is eventually sold, each owner is then selling their proportionate share, and the proceeds are split accordingly. As there are no payments between the landowners, there is no double taxation.

There is established case law to support the position that there should not be charges to CGT or Stamp Duty Land Tax (SDLT) on creation of the bare trust, although expert advice is required to value the pooled interests and proportionate interests in the pooled land, and care is needed in preparing the documentation.

There are, however, downsides to land pooling.

As the landowners will own different interests in land as a result of the pooling, they will lose any inheritance tax (IHT) or CGT reliefs that they may have earned due to the length of time they had held their land, for example Agricultural Property Relief (APR) and BADR. Qualification for BADR could be secured by the landowners farming the pooled land in partnership.

If the development does not proceed and the land is not sold, the bare trust may have to be unwound, which can be complicated.

Those contributing the land to the bare trust should register for VAT as a partnership, to allow VAT to be recovered on costs and to ensure the correct taxable person is bringing VAT on the sale of the land to account. There are complexities that arise when an interest in land is contributed to a bare trust, or indeed a partnership, and the deemed supply rules for VAT purposes may result in VAT needing to be brought to account by the party contributing that interest, subject to their VAT status. Such VAT is recoverable by the ‘partnership’ subject to certain conditions being met and expert advice should be sought.

This article was written before the higher rate of capital gains tax increased from 20% to 24% for disposals made on or after 30 October 2024.

Contact Us

Partner, Manchester

Key experience